Merchandise Purchased From Vendors Needs to Be Paid Within:

Jones Manufacturing uses the perpetual inventory system and made. First the payments need to be made in a business so you dont have to prepare a 1099-MISC for the guy who cuts your home lawn.

Analyze And Record Transactions For Merchandise Purchases Using The Perpetual Inventory System Principles Of Accounting Volume 1 Financial Accounting

3 discount if paid within 15 days balance due within 30 days 110 net EOM.

. In that statement alone there are some keys to what needs to be reported including. The n30 means that the invoice must be paid within 30 days. Course Title BSA 3A.

Vendors may need to have ____ added to their individual accounts. Merchandise returned by the. Increases when customers return merchandise and decreases when the company returns merchandise to vendors.

3 discount if paid within 15 days balance due within 30 days 110 net EOM. Example---210 n30 means a 2 percent discount is given if paid within 10 days and the net is due in 30 days. Jones Manufacturing purchased 10000 of merchandise inventory on account from a vendor and paid a 500 freight bill.

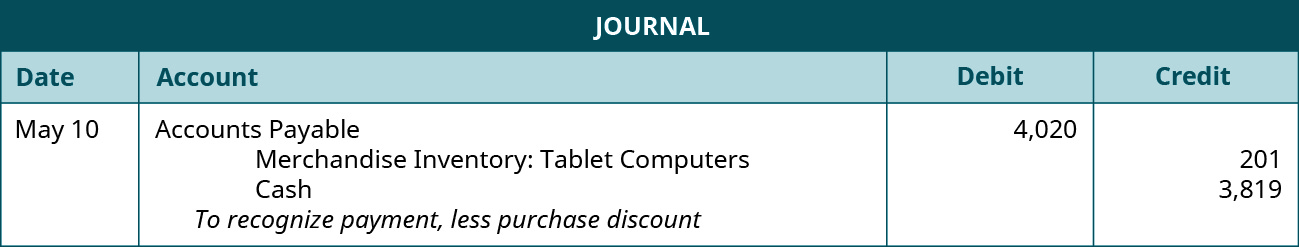

The purchase price was 5000 less a 10 trade discount and credit terms of 310 n30. When taking an early payment discount for the purchase of merchandise the discount amount is recorded. The merchandise purchased from outside vendors contained in the ending inventory.

The applicable Order or the Vendor Guidelines shall be paid by Vendor. In this case there is a 3 cash discount when the purchase is paid within 10 days else the entire balance must be paid within 30 days. Notwithstanding any incoterm or other shipping terminology used and unless agreed otherwise by the parties all Orders will be designated FOB.

A second lot on June 25 for 2000 paying the. Next you need to look at what kind of entity your vendor is. Subject to Purchase Order Terms and Vendor PoliciesAll Sales 11 All transactions involving sales of Merchandise from Vendor to ShopNBC shall be initiated solely by ShopNBC placing firm written purchase orders Purchase Orders with Vendors designated representatives.

If they are not part of the service provided you do not need to report payments for equipment. Because some of the merchandise was not needed Jones Manufacturing returned 2000 the same day. A Fixed Asset is something that you will own for ____ C.

A merchandiser is a business that sells merchandise or goods to customers. Form 1099-MISC is used to report payments made to vendors that provide services to a business. An _____ is a document that lists the credit terms and the quantity description unit price and total cost of the items shipped to the buyer.

Point of origin and title and risk of loss shall remain with Vendor until the Merchandise is. Purchase returns exist when sellers allow purchasers to return merchandise that. Chapter Four - Quiz Check my - Merchandise purchased from vendors needs to be paid.

However if the goods and supplies are part of the services provided by the independent contractors LLCs they would be included in the 1099-MISC form. In its first year FiCo which uses the perpetual method and records purchases at net buys two lots of sweaters 110 n30. The invoice price for a purchaser may need to be adjusted for purchase returns or purchase allowances.

Merchandise was purchased on account from Grants Distributors on June 12. Something that is paid for and will be used within one year is an B. If your vendor is a corporation a C Corp or an S Corp you do not need to.

This means that if any of your vendors fall into the categories above you dont need to issue them a 1099 if you havent paid them 600 or more. Debit Purchases Credit Accts Payable column and write the name of the vendor in the account title column. 315 eom means a 3 percent discount is given if paid within 15 days and the balance is due at the end of the month.

One lot on March 10 for 4000 paying the invoice on March 16. Vendor GD of 4500. This problem has been solved.

A business from which merchandise is purchased or supplies or other assets are bought. More than a year. The period of time within which an invoice must be paid in order to receive an amount off the invoice price is called an _____.

Please note that the 1099-MISC form is generally issued for payment of services provided. B Title and Risk of Loss. A form requesting that a vendor sell merchandise to a business.

1 To a Business. If you have paid them 600 or more keep them on the list. The merchandise purchased from outside vendors.

Purchase returns exist when sellers allow purchasers to return merchandise that. View Test Prep - D6EB5BFC-249F-464A-A127-71B8BC77DB25jpeg from 19688 6000 at CUNY Kingsborough Community College. The invoice price for a purchaser may need to be adjusted for purchase returns or purchase allowances.

A merchandiser is a business that sells merchandise or goods to customers. Pages 7 This preview shows page 3 - 5 out of 7 pages. The credit terms are 210 or n30.

The two ten means that 2 of the invoice can be deducted if paid within 10 days.

Artigram Martin Luther King Jr King Jr New Job

Artigram New Job Albert Einstein Truth

Craft Show T Shirt Vendor They Used Crates That Increased Table Capacity And Doubled As Risers Clothes Lin Shirt Display T Shirt Display Vendor Booth Display

Wholesale Boutique Vendorlist More Vendors Usa Suppliers Over 50 Ve Boutique Wholesale Wholesale Clothing Distributors Wholesale Boutique Clothing

No comments for "Merchandise Purchased From Vendors Needs to Be Paid Within:"

Post a Comment